By 2025, generic drugs are no longer just a cost-saving trick-they’re the backbone of healthcare systems from India to Germany. More than 90% of prescriptions in the U.S. are filled with generics. In South Korea, the government limits how many versions of the same drug can enter the market. In China, a single tender can slash prices by 90%. These aren’t random policies. They’re deliberate, data-driven strategies to make medicine affordable without sacrificing safety. But behind the numbers, there’s tension: how do you keep prices low without driving manufacturers out of business-or worse, compromising quality?

How Generics Work: The Basic Rule

Generic drugs aren’t knockoffs. They’re exact copies of brand-name medicines, down to the active ingredient, dosage, and how the body absorbs them. The only differences? The color, shape, or inactive ingredients like fillers. The FDA requires generics to be bioequivalent-meaning they deliver the same amount of medicine into the bloodstream within the same time frame as the original. That’s not a guess. It’s tested in clinical trials with real people.

The magic of generics isn’t in invention. It’s in replication. Once a patent expires, other companies can make the same drug without repeating expensive clinical trials. That cuts development costs by 80-90%. A drug that cost $500 for a 30-day supply as a brand might drop to $4 as a generic. That’s not a discount. It’s a revolution.

The U.S. Model: High Volume, Low Prices, But Still High Costs

The U.S. has the highest generic usage in the world: 90.1% of all prescriptions. That’s more than Canada, Germany, or the UK. And it works. In 2025 alone, Medicare saved $142 billion because patients got generics instead of branded drugs. That’s $2,643 saved per beneficiary.

But here’s the twist: even with all those generics, the U.S. still pays more for drugs than any other country. Why? Because the brand-name drugs are still outrageously expensive. Generics keep the system from collapsing, but they don’t fix the root problem. The real cost comes from the 10% of prescriptions that are still branded-often for new, complex drugs like cancer treatments or rare disease therapies.

The FDA approved over 11,000 generic drugs by the end of 2024. And they’re speeding things up. If a drug gets a Competitive Generic Therapy (CGT) designation-like Zenara Pharma’s Sertraline capsules approved in August 2025-it can get approved in as little as 8 months instead of the usual 2 years. That’s a big win for patients waiting for affordable options.

Europe: A Patchwork of Prices

In Europe, the story is different. The European Medicines Agency (EMA) approves generics for the whole bloc. But then? Each country sets its own price. So a pill approved in Brussels can cost 300% more in Germany than in Portugal. That’s not a mistake. It’s policy.

Some countries, like Germany, force pharmacies to substitute generics unless the doctor says no. Others, like Italy, barely use them. The result? A fragmented market where patients in one country get the same drug for half the price of their neighbor. Experts call it inefficient. Patients call it confusing.

And it’s getting worse. The European Union is trying to fix it with a new Pharmaceutical Package expected in late 2025. It aims to shorten approval times and give extra incentives to the first company to launch a generic. But will it work? Only if countries stop playing pricing games.

China: The Price-Cutting Machine

China’s Volume-Based Procurement (VBP) program is the most aggressive generic pricing policy ever tried. Instead of letting hospitals pick which generics to buy, the government holds giant auctions. Manufacturers bid to supply entire provinces. The lowest bidder wins-and gets a guaranteed market share.

The results? Average price drops of 54.7%. Some drugs, like certain blood pressure pills, fell by 93%. By 2025, over 400 drugs had been through VBP. But there’s a cost. Manufacturers are now making negative margins on some products. One in five companies reported losing money on VBP contracts. That leads to shortages. In 2024, Amlodipine-used by millions for hypertension-vanished for weeks in 12 provinces because no one could make it profitably.

China’s system works for affordability. But it’s fragile. If too many companies quit, patients lose access. The government is now expanding VBP to 150 more drugs in January 2026. Will the supply chain hold?

India: The World’s Pharmacy

India makes 20% of the world’s generic drugs by volume. It’s the supplier for Africa, Latin America, and even parts of Europe and the U.S. How? Because it can. India’s patent laws allow generic makers to copy drugs even before patents expire-if they can prove the original drug wasn’t truly innovative. That’s called compulsory licensing.

But quality is a gamble. Between 2022 and 2024, FDA warning letters to Indian manufacturers jumped 17%. Many of those letters cited data integrity issues-fake test results, missing records, manipulated lab data. The Access to Medicine Foundation says this isn’t about corruption. It’s about pressure. When you’re selling a pill for 10 cents, you can’t afford to spend $10 million on quality control.

Still, India’s role is irreplaceable. Without it, millions in low-income countries couldn’t afford HIV meds, antibiotics, or insulin. The trade-off? Speed and scale over perfection.

South Korea: The Middle Ground

South Korea didn’t go all-in on price cuts. Instead, it built a system that rewards quality. In 2020, it launched the ‘1+3 Bioequivalence Policy’: only three generic versions of any drug can be approved, based on who submits the best bioequivalence data first. Then, in 2021, it introduced pricing tiers:

- Generics that meet both quality and price standards: 53.55% of brand price

- Those that meet one: 45.52%

- Those that meet neither: 38.69%

It worked. Redundant generics dropped by 41%. But new generic launches fell by 29%. Why? Because the market got too crowded. Companies stopped trying. The policy saved money, but it also slowed competition. Now, patients get cheaper drugs-but fewer choices.

Japan: The Silent Cut

Japan doesn’t have a big auction system or a national formulary. Instead, it does something quieter: every two years, the government forces all drugs-brand and generic-to lower their prices. It’s automatic. No bidding. No negotiation. Just a cut.

Result? Generic use is high-76.8% by volume-but the market hasn’t grown in years. Manufacturers can’t make enough profit to invest in new products. The system keeps prices low, but it also kills innovation. Even generics become stale.

The Hidden Risk: Quality Under Pressure

Every country wants cheaper drugs. But no one talks about what happens when manufacturers are squeezed too hard.

Between 2020 and 2024, the FDA issued 936 more import alerts for generic drugs from overseas. That’s a 75% jump. Most were for poor manufacturing practices: dirty facilities, falsified records, inadequate testing. These aren’t just paperwork issues. They’re safety risks.

Doctors in India report that some locally made generics for epilepsy and blood thinners don’t work consistently. Patients on the same dose have wildly different blood levels. That’s dangerous. A 10% drop in anticoagulant levels can mean a stroke. A 10% spike can mean internal bleeding.

The WHO says manufacturers need at least a 15-20% gross margin to maintain quality. In China, 23% of generic makers are operating at a loss. In India, some sell pills for less than the cost of the packaging. That’s not sustainable. It’s a ticking time bomb.

What’s Next? The Big Changes Coming

The next five years will reshape the global generic market. In the U.S., the Inflation Reduction Act will let Medicare negotiate prices for 10-20 high-cost drugs each year starting in 2028. That could cut branded drug prices by 25-35%. That’s a direct threat to pharmaceutical profits-and a huge opportunity for generics.

China’s VBP expansion in January 2026 will add 150 more drugs, with winners required to supply 80% of hospital demand at prices 65% below current levels. That’s the most aggressive price cut yet.

And the biggest catalyst? Patent expirations. Between 2025 and 2030, $217-$236 billion in branded drug sales will lose protection. That’s a gold rush for generic makers-if the policies let them in fast enough.

What This Means for You

If you’re on a generic drug, you’re probably saving hundreds or thousands a year. That’s real money. But you should know: not all generics are created equal. In the U.S., your pharmacy benefit manager (PBM) might charge you more for a generic than the brand-because they get kickbacks from drug companies. Ask your pharmacist: is this the cheapest option? Is it covered?

If you’re in Europe, don’t assume your neighbor’s price is the same as yours. Check your local formulary. If you’re in a low-income country, your access to generics depends on global supply chains-and those are fragile.

Generics aren’t just cheaper drugs. They’re a political choice. Every policy decision-whether it’s price caps, quality checks, or patent rules-has a human cost. The goal is simple: make medicine affordable without making it unsafe. So far, no country has nailed it. But some are getting closer.

Are generic drugs really as safe as brand-name drugs?

Yes. The FDA, EMA, and WHO all require generics to prove they deliver the same amount of active ingredient into the bloodstream at the same rate as the brand. This is called bioequivalence. For most drugs, generics are identical in effect. The only exceptions are narrow therapeutic index drugs-like warfarin or lithium-where even tiny differences matter. In those cases, doctors may prefer to stick with one brand.

Why do some generics cost more than others?

It’s usually about manufacturing, location, and market competition. In the U.S., a generic made by a large company with efficient production might cost less than one made by a smaller firm. Insurance formularies also play a role-some plans charge higher copays for certain generics to steer patients toward cheaper options. In Europe, prices vary wildly by country because each nation sets its own reimbursement rate.

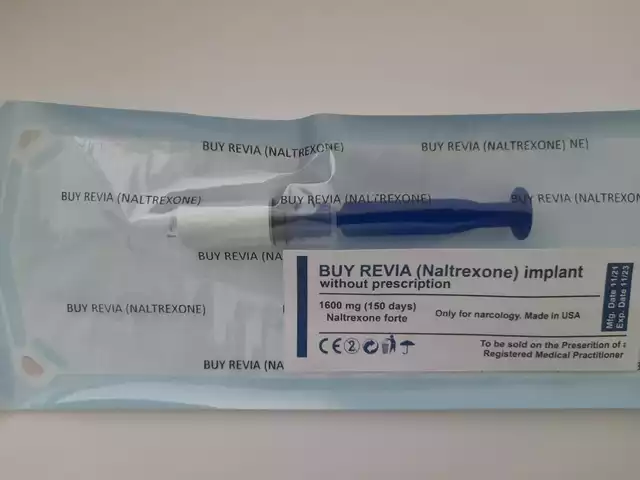

Can I trust generics made in India or China?

Many are perfectly safe. The FDA inspects over 3,000 overseas manufacturing sites each year. But inspections have increased since 2020-and so have warning letters. The risk isn’t that all Indian or Chinese generics are bad. It’s that some manufacturers cut corners under pricing pressure. Look for FDA-approved products. If your pharmacy sources from reputable distributors, the risk is low.

Why don’t doctors always prescribe generics?

Sometimes, it’s habit. Other times, they’re unsure about bioequivalence for complex drugs. In countries like the U.S., insurance rules can force pharmacists to substitute, but doctors still need to write "dispense as written" if they want to override it. Patient concerns also play a role-if a patient believes generics are inferior, some doctors avoid them to maintain trust.

Will generic prices keep falling forever?

No. When prices drop below manufacturing cost, companies stop making the drug. We’ve already seen shortages in China and India because no one could profit. The next phase won’t be about lower prices-it’ll be about sustainable pricing. Governments are starting to realize that if no one makes the drug, the savings don’t matter.

What You Can Do

Ask your pharmacist: "Is there a generic version? What’s the cost difference?" If you’re on Medicare or Medicaid, check your formulary online. If you’re in Europe, compare prices across neighboring countries using tools like the EU’s eHealth Portal. If you’re in a developing country, ask your clinic if they use WHO-prequalified generics-they’ve been vetted for quality.

Generics are one of the most powerful tools in modern medicine. But they only work if the system supports them-not just financially, but ethically. The goal isn’t to make drugs cheap. It’s to make them accessible, reliable, and safe. That’s the real global challenge.

December 12, 2025 AT 12:56

Webster Bull

Generics are the unsung heroes of modern medicine. No one throws them a parade, but they keep millions alive. That $4 pill? Could be the difference between taking your meds or skipping them. Simple as that.

Stop acting like cheap = bad. It’s not. It’s smart.

December 12, 2025 AT 13:42

Bruno Janssen

I don’t trust anything made overseas anymore. The FDA inspections are just PR. My cousin got sick from a generic from India. No one talks about that.

December 13, 2025 AT 12:48

Scott Butler

China’s system is socialism gone wild. You don’t crush companies to save a buck. You destroy innovation. And now we’re all stuck with shortages because some bureaucrat thought he was being clever.

Meanwhile, we’re still paying more than everyone else for the 10% of drugs that aren’t generic. What a mess.

December 15, 2025 AT 11:00

Emma Sbarge

The real issue isn’t price-it’s accountability. If a generic fails, who’s liable? The manufacturer? The distributor? The pharmacy? No one. And patients pay the price. Literally. We need traceability, not just cost cuts.

December 16, 2025 AT 02:48

Donna Hammond

There’s a huge misconception that generics are all the same. They’re not. Bioequivalence is a minimum standard, not a guarantee of identical performance. For drugs like warfarin, thyroid meds, or seizure controllers, consistency matters. Some patients do better on one brand over another-even if it’s technically "the same". Doctors should have more flexibility to choose based on patient history, not just cost.

And yes, quality control is a nightmare in some factories. But the FDA’s increased inspections are a good sign. We’re seeing more transparency, even if it’s painful for manufacturers. The system’s flawed, but it’s trying to fix itself.

December 16, 2025 AT 12:40

Richard Ayres

It’s fascinating how different countries approach this. The U.S. relies on volume and market competition. China uses state coercion. India leverages legal loopholes. South Korea tries to balance quality and cost. Each has trade-offs. But the common thread? Patients are the ones who suffer when the system breaks. We need a global framework-not just national patchworks. Maybe the WHO should lead it.

December 18, 2025 AT 08:59

Sheldon Bird

I get why people are scared of generics. I used to be too. But after my dad switched from a $300 brand to a $5 generic for his blood pressure and didn’t have a single issue? I changed my mind.

Don’t fear the generic. Fear the system that lets drug companies charge $500 for a pill that costs $2 to make. That’s the real villain.

December 19, 2025 AT 05:13

Michael Gardner

You all think China’s the only one cutting prices? Try Japan. They force drug prices down every two years. No bidding. No negotiation. Just a government decree. Result? Generic makers are barely surviving. Innovation’s dead. You want cheap? You’ll get stale. And then what? No new drugs at all?

December 19, 2025 AT 16:53

Willie Onst

India’s pharmacy? Yeah, they make a lot. But let’s be real-some of those pills are made in places where the power goes out twice a day. How do you guarantee quality when your lab’s running on a generator? It’s not about corruption. It’s about survival. We need to help them build better infrastructure, not just yell at them for being cheap.

Also, shoutout to the Indian scientists who made insulin affordable for millions. They’re the real MVPs.